58% of VC Cash Goes to AI

Global investment in AI startups from January – June 2025 far outpaced H1 2024. Q1 2025 alone absorbed an estimated $60 – $73 billion, already more than half of 2024’s full-year total and driving a >100 % year-over-year surge. AI companies captured roughly 58 % of all venture dollars in Q1 versus ~28 % a year earlier—clear evidence of investor “AI FOMO.”

Implication: Capital is concentrating in AI at an unprecedented scale, likely reshaping H2 allocations as firms double-down on perceived AI winners.

Mega-rounds dominated by a few giants

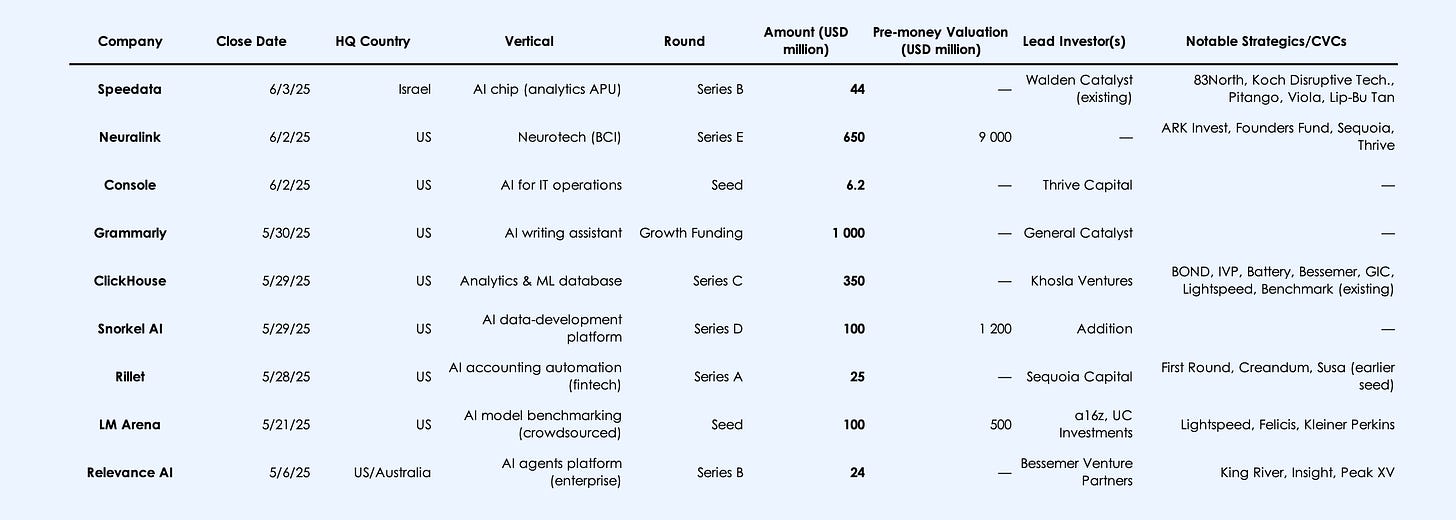

Outsized later-stage rounds for foundation-model leaders defined the period. OpenAI’s $40 billion raise in March (the largest private round ever) valued it at $300 billion, while Anthropic’s $3.5 billion Series E put it at $61.5 billion. A handful of additional deals—e.g., Safe Superintelligence ($2 billion) and Neuralink ($650 million Series E)—further skewed totals.

Implication: A “winners-take-most” dynamic is funneling the bulk of funding to a very small cohort, soaking up capital that might otherwise flow to earlier-stage or smaller firms.

Barbell effect on deal sizes

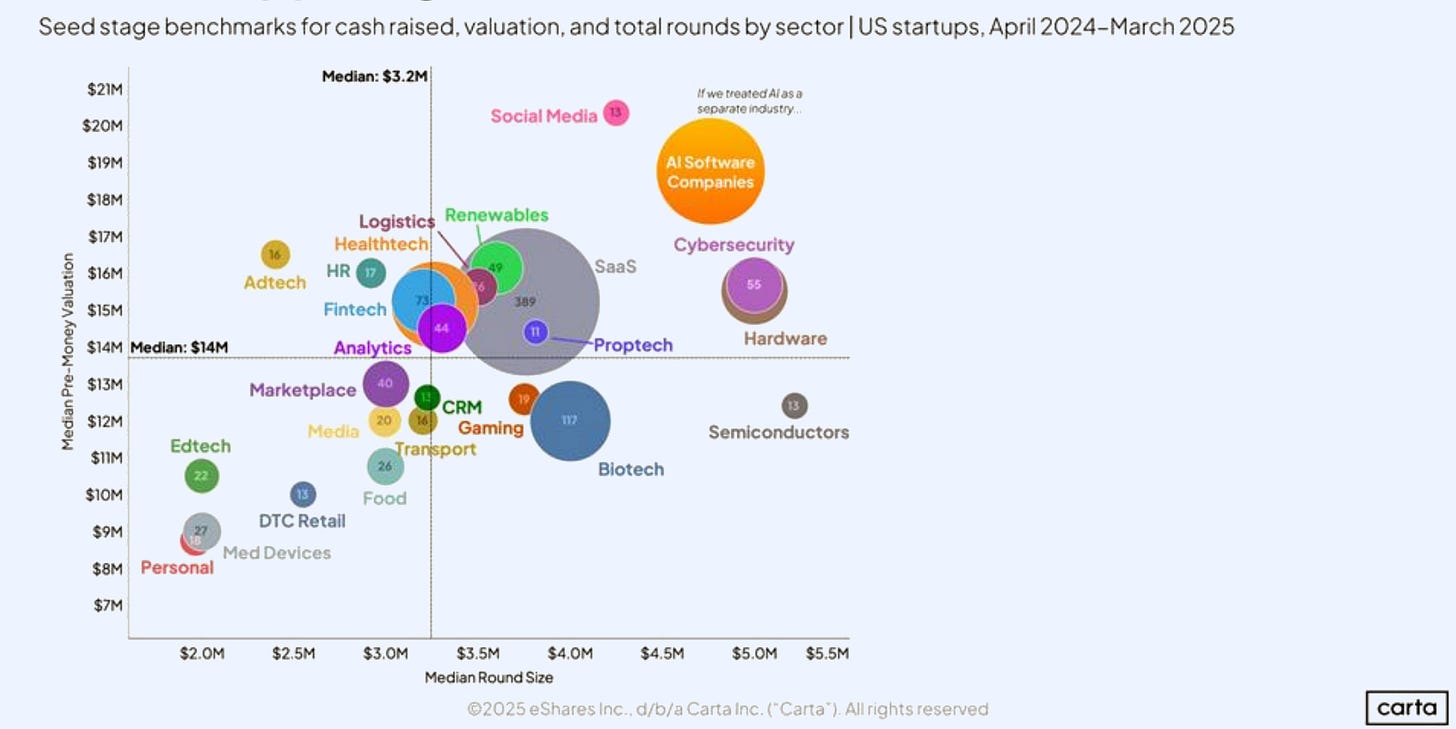

Beyond the headline mega-rounds, mid-sized deals proliferated while seed activity remained selective. Median AI seed rounds reached ~$15 million (average ~$41 million), and median Series A hit ~$75 – $80 million—both well above historical norms (global median Series A across sectors was ~$10 million in 2022). Growth-stage medians for Series C/D clustered around $250 – $300 million, with averages distorted upward by outliers like OpenAI.

Implication: Deal-size inflation reflects fierce competition for category leaders. Investors unable to write nine-figure checks may pivot to niche plays or earlier stages, while any startup flashing an AI story commanded larger rounds and valuations.

Sector and geography concentration

Generative AI and core model/infrastructure players absorbed $45 + billion—over 95 % of disclosed dollars—in H1. Applied-AI verticals were relatively starved (health/biotech ~$0.7 billion; fintech/enterprise ~$2 – $3 billion). Geographically, the U.S. (especially Silicon Valley) dominated: >99 % of H1 AI funding by value went to Americas-headquartered companies. Asia and Europe lagged—China’s largest deal (Zhipu AI) raised $247 million, and Europe saw only mid-sized rounds (e.g., UK’s Latent Labs at $50 million).

Implication: The boom is highly U.S.-centric and led by a few big players; expect non-U.S. governments and investors to respond in H2 with national AI funds, incentives, or cross-border capital to avoid falling behind.

H2 2025 outlook: exuberance tempered by scrutiny

Despite record capital deployment, investor discipline is resurfacing. Many H1 rounds featured strategic or corporate backers (cloud providers, chipmakers, defense primes), signaling a tilt toward tangible use-cases and strategic synergies. Heading into H2, investors will watch how mega-funded startups execute—product delivery, revenue, regulatory navigation—amid intensifying competition.

Implication: H2 capital is likely to favor firms demonstrating efficiency and real market traction—particularly “picks-and-shovels” providers (tools, chips, enterprise software)—raising the bar for newcomers and reinforcing incumbent advantages while challenging fresh entrants.

Why it matters

The first half of 2025 represents a make-or-break moment for the AI investment thesis. The flood of capital into AI now (and its skew toward a few players and regions) will shape the innovation landscape and competitive dynamics for years. For investors, understanding where the money is going – and why – is critical for navigating H2 2025. Will the winners justify their valuations, or will we see a pullback and refocus? The data from H1 provides early clues, informing portfolio strategy, policy considerations (like antitrust and national-security concerns), and founders’ fundraising prospects in the next half-year.

Macro & Trend Analysis – Structured Overview

1. Funding Momentum: Unprecedented YoY spike

In the first half of 2025, venture funding into AI startups far exceeded the pace of 2024.

Reliable tallies indicate ~$70 billion flowed to AI companies in Q1 alone – more than half the total AI funding of all 2024.

That puts H1 2025 well above H1 2024 by >2× in dollar terms.

AI’s share of global VC funding jumped to ~53–58 % in Q1 2025, up from roughly 25–30 % a year prior – i.e. over half of all venture capital worldwide is now going to AI.

Driver: a handful of massive rounds; absent those, global VC funding would have been roughly flat YoY.

Implication for H2 2025: overall venture metrics may hinge on AI dealflow; any cooling in AI enthusiasm could drag down aggregate funding levels.

2. Funding Stages: Late-stage soars, early-stage mixed

The data reveal a barbell distribution in AI deal sizes.

Later-stage (Series C+) dominated: $81 billion across all sectors in Q1 2025, up ~147 % YoY, with AI the primary driver.

Series D/E rounds averaged ~$300–950 million (median ~$250–450 million).

Early-stage: deal counts fell (global early-stage deals down ~19 % YoY), yet round sizes ballooned.

Median AI seed in H1 2025 hit ~$15 million; outliers like Lila’s $200 million seed set the tone.

Median Series A hovered ~$75–80 million.

Takeaway: investors funneled money into fewer, bigger bets – confidence in select AI theses, caution elsewhere. The polarization should persist in H2.

3. Sector Allocation: Foundation models & infra on top

~95 %+ of AI dollars chased generative-AI model developers and their infrastructure (cloud compute, chips, dev platforms).

OpenAI and Anthropic alone soaked up ~60 % of H1’s AI capital.

Vertical applications were a rounding error by comparison:

Healthcare/biotech AI: ~$0.7 billion (e.g., Hippocratic AI $141 m, Insilico $110 m).

Fin-serv & enterprise productivity: only a few billion combined.

Robotics/defense AI: niche but notable (e.g., Shield AI $240 m).

Investor logic: control the “AI stack”; vertical apps may commoditize or face longer GTM cycles.

4. Geographic Split: U.S. leads, others lag

71–73 % of global VC funding went to North America in Q1; for AI the concentration was ~99 % U.S. by value.

SF Bay Area alone represented nearly half of global VC when counting OpenAI.

EMEA: just a few mid-sized AI deals (Latent Labs $50 m, Speedata $44 m).

Asia-Pac: drought – only $1.8 billion in Q1 2025 AI raises (down 50 % YoY); China’s headline round was Zhipu AI $247 m.

Bottom line: the U.S. is pulling away in the “AI arms race” financially.

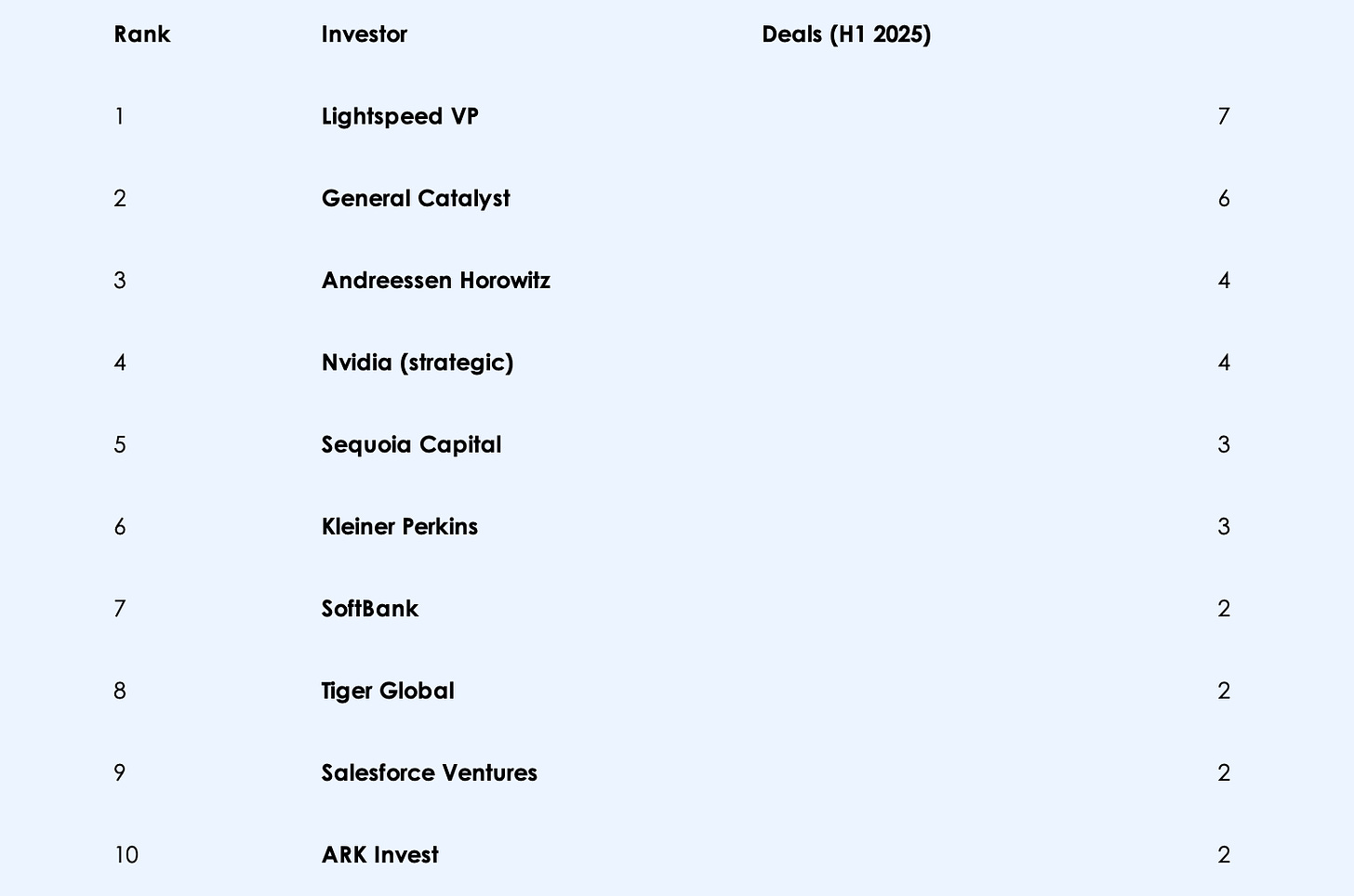

5. Investor Landscape:

Sovereign wealth & crossover funds (Saudi’s Prosperity7, Malaysia’s Khazanah, Thrive Capital) led marquee rounds.

Big Tech CVCs (Microsoft, Salesforce, Google) are highly active.

Net effect: capital crowd-in from all sides.

Forward-Looking Outlook: H2 2025

Regulatory Milestones

Governments are still figuring out how to handle AI. In the EU, the AI Act may be finalized by the end of 2025. Expect lobbying wars and possibly early compliance signals from startups in H2. In the U.S., Biden’s executive orders on AI and any movement in Congress—hearings, proposed legislation—will be critical. Emerging rules around data usage, model transparency, or chip export controls could reshape startup economics and investor confidence.

Positive scenario: Clearer, business-friendly guidelines legitimize AI adoption across sectors.

Negative scenario: Heavy-handed rules (e.g., liability for AI mistakes) could spook startups and investors.

Also, keep an eye on U.S. government AI procurement—rumors of a multi-billion-dollar initiative could provide a serious demand signal for enterprise-focused AI firms.

IPO Pipeline & Exit Pathways

Despite 2025’s private funding surge, we’ve yet to see a breakout AI IPO. This might change in H2. Names like Databricks, Stripe (AI-adjacent), or even OpenAI are floating as potential IPO candidates.

A successful IPO could reprice the market, unlock late-stage liquidity, and provide comps.

A continued IPO drought might shake investor confidence in AI startup exit timelines.

Meanwhile, M&A activity may escalate. Big Tech could strike: Google, Microsoft, or NVIDIA might grab smaller AI teams or core infrastructure players. Think of what CoreWeave–W&B ($1.7B) or Google’s pending $32B acquisition of Wiz hinted at. A blockbuster AI acquisition could redraw the competitive map and return capital to VCs.

Technical Breakthroughs & Product Launches

We’re expecting big reveals: possibly OpenAI’s next-gen model or hardware debuts from the Sam Altman/Jony Ive collaboration.

Any step-change in capabilities (e.g., models that reason or are 10× cheaper) could validate high valuations and trigger new capital waves.

Look for enterprise traction too—API sales, SaaS adoption, and revenue proof points.

But risks exist: a safety incident or public misuse could invite regulatory blowback and deflate sentiment.

Bottom line: Execution in H2—both technical and commercial—will determine whether H1’s exuberance holds up.

Regulatory & Ethical Backlash

If governments or the public feel AI is out of control, expect rapid interventions: licensing schemes, GDPR-enforced fines, or hard restrictions on certain models.

Ethical drag: Scandals, mass layoffs from automation, or AI-generated misinformation could shift sentiment fast—and make capital harder to deploy.

Compute & Talent Constraints

AI’s lifeblood—GPUs and elite engineers—remains scarce.

GPU bottlenecks could sideline underfunded teams while well-capitalized firms hoard compute.

Talent wars are intensifying, with OpenAI and Google locking up top minds.

Burn rates are ballooning: Some startups are spending $100M+ annually on cloud without shipping fast. If that gap between cost and product grows, expect down-rounds and brutal resets.

Model Commoditization

Ironically, the LLM race is driving rapid commoditization. Open-source releases (Meta’s LLaMA, Mistral, etc.) blur differentiation.

Moats are shifting to data quality, distribution, or vertical integration.

If OpenAI starts losing out to lean open-source players or if enterprises roll their own models, VCs may revisit what “defensibility” really means.

H2 could be a wake-up call: not every fine-tuned wrapper deserves a billion-dollar valuation.

Predictions for H2 2025

Funding Moderates, But Remains Elevated

Post-H1 euphoria, deal pace will cool. We don’t expect another $40B round, but quarterly AI funding will still double 2024 levels.

The boom continues—just more measured.

One Major Liquidity Event Hits

Expect at least one $10B+ exit: IPO (e.g., Databricks) or a mega-acquisition by a legacy player trying to stay relevant.

This will shape investor mood and reset pricing expectations.

Clear Stratification in the Startup Ecosystem

By Q4, the split will be obvious:

The top 5–10 AI firms (with war chests and traction) will pull away, likely making acqui-hires.

Mid-tier or hyped startups without product-market fit? Many will pivot, down-round, or fade.

Investors will reward revenue-generating execution, not just research decks or GPU consumption.

Final Take

The next six months will stress test the AI narrative.

Is 2025 the start of a sustained revolution, or a bubble needing correction?

Our view: Some froth will burn off, but the core thesis holds. AI remains the most compelling frontier in venture—just expect more discipline in how the capital flows.

Sources

Crunchbase News – “Q1 Global Startup Funding Posts Strongest Quarter Since Q2 2022…” (Apr 2025)

HumanX/Crunchbase – “AI led global funding (2024 report)” (Jan 2025)

TechCrunch – “19 US AI startups raised $100M+ in 2025” (Apr 23 2025)

Disclaimer

The content of Catalaize is provided for informational and educational purposes only and should not be considered investment advice. While we occasionally discuss companies operating in the AI sector, nothing in this newsletter constitutes a recommendation to buy, sell, or hold any security. All investment decisions are your sole responsibility—always carry out your own research or consult a licensed professional.