How Lovable Reached 2.3M Users

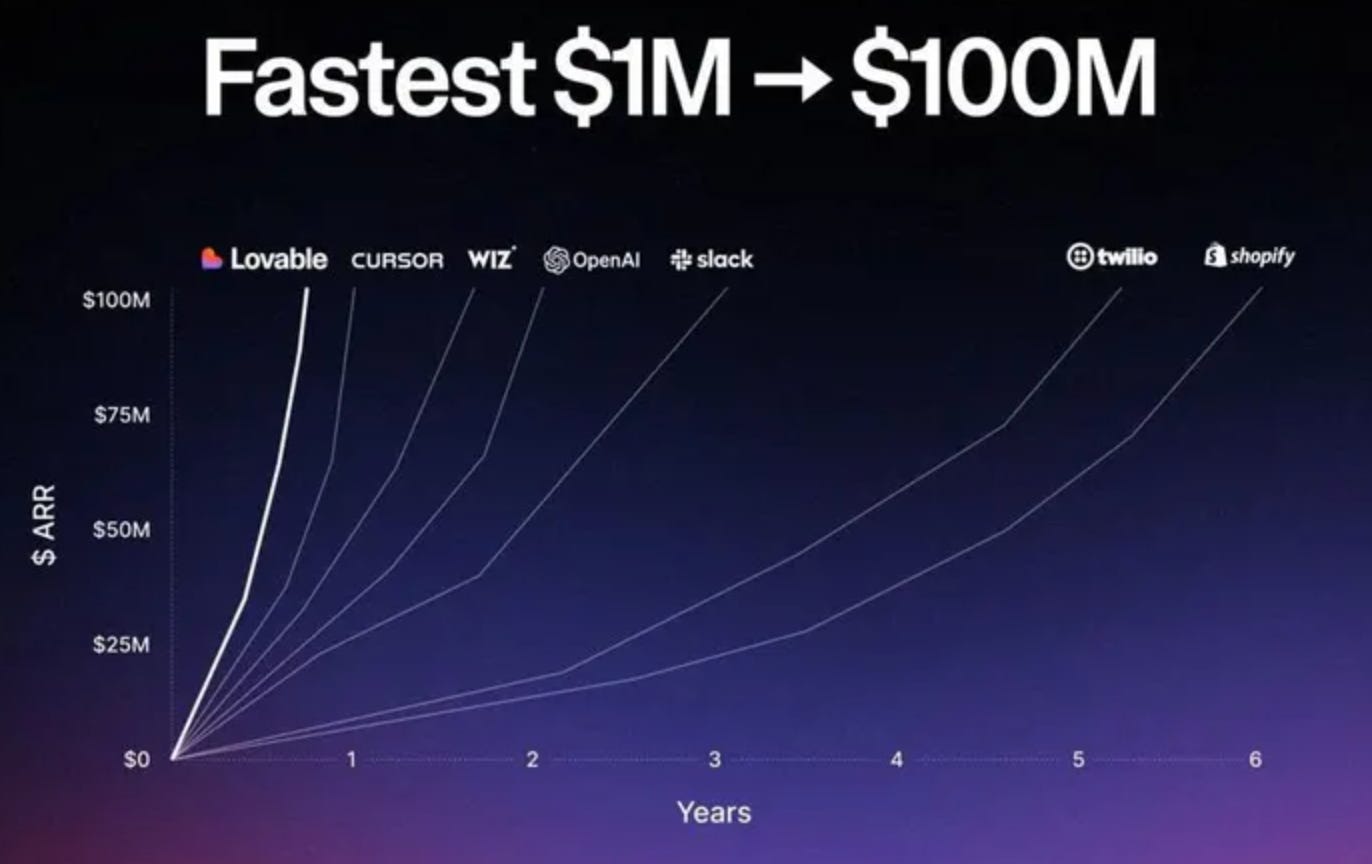

Lovable is a Stockholm-based AI startup that achieved $100 million ARR in just 8 months after launching in late 2024, making it one of the fastest-growing software ventures ever. The company reached this “centaur” milestone (>$100M ARR) with only ~45 employees and minimal funding spent, highlighting an exceptional revenue-to-headcount ratio. It now projects $250M ARR by end of 2025 and ambitiously targets $1 billion ARR within 12 months.

Lovable was founded in 2023 by Anton Osika (CEO) and Fabian Hedin (CTO) to “empower the 99% who can’t code” by building apps through natural language. The product began as an open-source project called GPT Engineer that went viral – amassing over 52,000 GitHub stars and a 27,000-person waitlist by late 2024. After rebranding to “Lovable” in Nov 2024, the team launched a beta that hit #1 on Product Hunt and Hacker News, proving massive early demand for its AI “vibe coding” approach.

Lovable’s cloud platform lets users build full-stack web applications by simply chatting with an AI. A non-programmer can describe features in plain English (“Build a social feed with login”) and Lovable generates working code for the frontend, database, and backend logic. It leverages large language models (GPT-4, etc.) behind the scenes to produce production-grade React/TypeScript code and SQL, integrated with a Postgres database via Supabase for auth, storage, and serverless functions. This “vibe coding” approach – just describe the desired app and let the AI handle code – dramatically lowers the barrier to software creation.

In July 2025, Lovable introduced Lovable Agent, an AI agent that can autonomously plan, code, and fix a project with minimal user guidance. The Agent reads the project files, makes multi-step edits across files, performs web searches or API calls (e.g. fetches external data), generates images, and debugs errors – behaving more like a collaborative human developer. This upgrade (enabled by fine-tuning and retrieval techniques) made complex tasks 91% less error-prone and allowed long-running, multi-file edits to succeed without step-by-step prompts. By defaulting all new users to Agent mode, Lovable aims to consistently deliver successful builds of more ambitious, production-ready apps – not just toy prototypes.

Use Cases and Limitations

Most of Lovable’s 2+ million users initially used it for rapid prototyping – e.g. startup founders building MVPs, designers turning Figma designs into live apps, or business analysts automating workflows. Successful examples include AI-powered photo apps, lightweight CRMs, and even students launching side-businesses from their dorms. Enterprises have dabbled mainly in innovation teams and hackathons (Klarna and HubSpot are early customers), but broader enterprise adoption has been cautious due to code ownership and security concerns around “AI-made” software. Lovable is addressing these with features like Security Scan and AI code review (to catch vulnerabilities), an opt-out from data being used in training (for business tier users), and plans for on-premise options. Users can export or sync the generated code to their own GitHub, ensuring full code ownership and enabling a handoff to engineers as needed. However, Lovable’s agent today still performs best within its supported stack (React + Supabase); very custom architectures may require manual coding beyond Lovable’s scope.

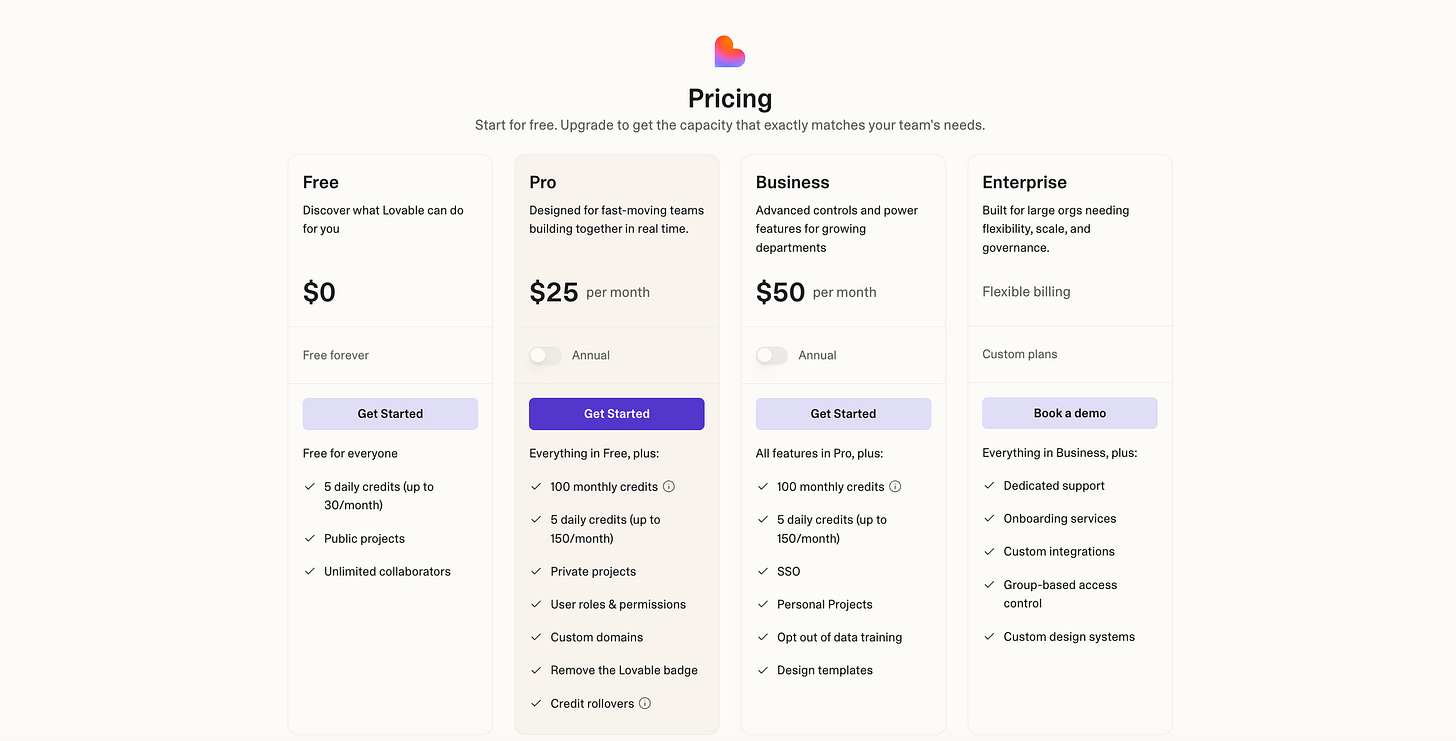

Monetization & Pricing

Lovable runs a subscription + usage model. The core Pro plan costs $25/month and includes a fixed quota of AI credits (e.g. 100 credits + 5 credits/day rollover), which roughly correspond to AI operations. A higher Business plan at $50/month adds enterprise features (SSO, team collaboration workspace, data privacy controls) but the same base credits. All plans can purchase additional credits if needed, and there’s a free tier to start. This usage-based pricing means heavier app builders pay more (one user built a 29,000-line app for ~$250 in credits), protecting Lovable’s margins against expensive model calls. Notably, in mid-2025 Lovable eliminated its old “Team” tier, moving all teams to the cheaper Pro plan to include collaboration features by default – a rare negative revenue move ($1.5M ARR dropped overnight) intended to prioritize growth and accessibility. The company also launched a 50% student discount and campus hackathons to drive adoption among the next generation of builders.

Traction – Surging Users and Revenue

After launch, Lovable’s growth has been explosive. By February 2025 (3 months in) it reported 500,000 users and $17M ARR with 30,000 paying customers – achieved with just $2M of its seed funds spent. Daily project creation jumped from ~25k/day in Feb to 100k+ new projects per day by July 2025 as the user base swelled to 2.3 million active users and 180,000 subscribers. These users have collectively built over 10 million applications on Lovable in its first 8 months. Revenue climbed in tandem: $1M→$10M ARR in 2 months, $17M by month 3, $50M by month 6, and $100M by month 8. This trajectory outpaced even well-funded peers (for example, competitor Cursor took ~12 months to $100M ARR) and has few precedents in European tech. The “what to believe” reconciliation: some third-party sources cited ~$70–75M ARR in June 2025 – Lovable’s CEO later clarified $75M was reached around month 7, so we treat the higher number as accurate. Overall, primary metrics from Lovable (often shared via press or CEO’s posts) have been corroborated by independent outlets like TechCrunch. Minor discrepancies (e.g. ARR rounding) aside, the growth story is consistently one of hyper-scale.

Funding – From Seed to a Historic Series A

Investors have aggressively backed Lovable’s vision. In October 2024, it raised a €6.8M pre-seed led by Hummingbird and byFounders to build out the initial team. This was followed by a $15M “pre-Series A” round in Feb 2025 led by Creandum, announced on the heels of Lovable’s rapid early revenue gains. Just five months later, Lovable closed one of Europe’s largest Series A rounds ever: $200 million at a $1.8 billion valuation in July 2025. Accel led this Series A, joined by existing investors (Creandum, 20VC, byFounders, Hummingbird, Visionaries Club) and an all-star cast of angel backers including the CEOs/co-founders of Klarna, Slack, Canva, Datadog, Remote, and more. The $1.8B post-money valuation minted Lovable as a unicorn just ~8 months from launch, the fastest in Sweden’s history. The funds are earmarked to expand hiring (especially world-class engineers) and accelerate product development, particularly around the AI agent and enterprise features. With this war chest, Lovable now faces pressure to sustain momentum – but notably, management has hinted they are not gunning for short-term profit, even willing to sacrifice ARR (as seen with pricing changes) to maximize long-term user growth.

Competitive Landscape

Lovable sits at the intersection of no-code app builders and AI coding assistants – a hotly contested space in 2025. Its most direct rivals include Cursor (Anysphere), Replit Ghostwriter/AI, emerging autonomous coders like Cognition’s Devin, and even incumbents like Bubble and Retool adding AI. Cursor, focused on AI pair-programming for professional developers, has grown extraordinarily – surpassing $500M ARR by mid-2025 largely via individual dev subscriptions and raising $900M at a $9.9B valuation. Unlike Lovable, Cursor ($20/mo Pro, $40/mo Biz) targets coders in their IDEs and recently introduced enterprise licensing. Replit, an online coding platform, leveraged its 20M+ user base to introduce AI code generation (“Ghostwriter” and an Agent) and similarly rocketed to $100M ARR by mid-2025 – though Replit’s users are mostly developers or students, and it emphasizes multi-language coding rather than Lovable’s single-stack simplicity. Other agentic coder startups such as Devin are pursuing enterprise software teams with autonomous AI engineers (Goldman Sachs’s deal with Devin made headlines), but these are at early stages and often require significant dev oversight – one review noted Devin’s agent “can build and test code, but results vary on complex tasks”. Traditional no-code platforms like Bubble and low-code enterprise tools like Retool have begun integrating generative AI (e.g. Bubble’s AI assistant to generate pages, Retool’s AI to build internal app UI from prompts). However, those incumbents have not (yet) matched Lovable’s end-to-end code generation or its traction – Bubble remains popular for visual building but outputs proprietary configurations rather than editable code, and Retool is focused on internal dashboards with pricing per end-user. In summary, Lovable’s edge is in serving non-programmers who want real, extensible code. Competitors either cater to developers (faster coding but assuming coding knowledge) or offer no-code ease with limited extensibility. The enclosed comparison table highlights how Lovable stacks up on positioning, pricing, and features relative to key peers.

Go-to-Market & Community

Lovable has grown with a product-led, community-driven strategy. The team credits social media virality and user evangelism for its early growth – “build in public” tweets, demo videos on TikTok/YouTube, and users sharing what they built (#BuiltWithLovable) created a flywheel of adoption. A strategic Product Hunt launch and Hacker News post in late 2024 seeded its initial user base with tech enthusiasts. Lovable then leaned into content marketing and partnerships: co-marketing with dev platforms like Supabase (webinars, example apps) and showcasing user success stories in its blog and YouTube channel. It also launched an affiliate program and a “Hire a Partner” network to enlist agencies and freelancers who build on Lovable – expanding distribution through service providers. For broader reach, Lovable offers deep student discounts and sponsors hackathons (the “Lovable Back-to-School” campaign in Aug 2025 paired 50% off Pro accounts with campus hackathons). This not only drives student sign-ups but could embed Lovable in university curricula and startup incubators. Notably, the company has not built a traditional outbound sales force to date – its enterprise motion is nascent, handled by a small team dealing with inbound interest from companies. The Series A investors noted Lovable’s vibrant community and “intense execution focus” as key, suggesting the founders will continue prioritizing community support and rapid product improvements to sustain word-of-mouth growth. Going forward, Lovable’s GTM challenge will be converting prototype use into production usage (increasing retention) and cultivating larger deployments in business settings – likely via more enterprise partnerships and perhaps a future marketplace where third-party developers can publish Lovable “extensions” or templates.

Unit Economics & Risks

As an AI-native SaaS, Lovable’s gross margins are constrained by upstream API costs – each user prompt invokes OpenAI, Anthropic, or other models. Initially, this meant lower margins than traditional pure software (which has near-zero cost of service per user). However, Lovable’s usage-based pricing recovers these costs from customers, and model inference costs have been trending down (CEO Anton Osika noted that model cost declines are already improving Lovable’s margins in mid-2025). With $100M+ ARR largely from self-serve subscriptions, Lovable likely enjoys healthy gross profit in absolute terms, but any shocks in API pricing or model availability are a key risk. The company mitigates this by multi-sourcing models (e.g. adding Google’s Gemini model when available) and could train proprietary models in the future (especially given $200M fresh funding) – though matching GPT-4’s coding ability would be a tall order. Scaling usage vs. retention: another risk is that many users may churn after the prototyping phase. Lovable acknowledged that most current projects are prototypes or “tests” – if users don’t stick around to maintain or scale those apps, subscription churn could rise. By introducing features for more serious development (version control, team collaboration, testing and security tools), Lovable is trying to drive apps “beyond prototype” into deployed products, which would increase retention and usage. Platform lock-in vs. flexibility: Lovable touts that users own their code (which can be exported), but if too many users export and leave the platform for production, that limits long-term revenue. The company’s bet is that its AI will continue to add value post-export (for new features, fixes, etc.) so users remain subscribed for the convenience and speed. Data privacy and IP are also concerns: enterprise prospects might worry about proprietary code or data being sent to third-party AI servers. Lovable’s introduction of private cloud options (for enterprise) and allowing users to opt out of contributing training data addresses some of this, but competing on security and compliance (SOC2, ISO certifications, on-prem deployment) will be crucial to unlock large enterprise deals. Lastly, competition itself is a risk – giants like Microsoft and Google are embedding similar AI app generation into their ecosystems (e.g. Microsoft’s Power Platform “Copilot” can build simple apps from text). Lovable must maintain a lead in quality and breadth of app generation. Its record growth to date gives it a strong head start, but richer competitors (and open-source AI advancements) are racing to automate software development. The next 12 months will test whether Lovable can sustain its torrid growth curve beyond the initial hype phase of “everyone trying out an AI builder” and truly penetrate mainstream software development workflows.

Outlook

Lovable’s near-term roadmap focuses on deepening the platform’s capabilities for complex builds and enterprise adoption. The founders have hinted at upcoming features like multi-modal support (vision-based prompting), integration of newest models (the company offered a limited preview of GPT-5 in Aug 2025), and possibly an “app store” for sharing community-built templates/components. Improving AI reasoning for larger applications is a priority – Lovable already uses retrieval techniques to handle large codebases, but it will aim for even more “architectural” intelligence (e.g. handling multi-service apps, APIs integration, performance optimizations) to broaden the range of what users can build. On the business side, CEO Anton Osika’s bold goal of reaching $1B ARR by mid-2026 will require accelerating an enterprise sales motion without losing the self-service charm. We may see Lovable hire a dedicated sales and solutions engineering team to pursue big contracts (the Series A funds make this possible). The financial trajectory if things go right: at the current ~$8–15M ARR net new per month, Lovable would end 2025 around $250–300M ARR and potentially cross $500M ARR in 2026 – within striking distance of “unicorn to decacorn” status in under 2 years. Conversely, a more conservative scenario (accounting for churn and competition) might have Lovable leveling off at a few hundred million ARR and requiring more time or another product pivot to hit $1B. Either way, Lovable has already catalyzed a new market narrative – that non-developers can create real software, fast – and it has positioned itself as a category-defining leader of this “AI software generation” movement. The next year will reveal if it can transform its early sprint into lasting, at-scale success in the face of intensifying competition and the natural limits of its initially prototype-driven use cases.

Conclusion

In conclusion, Lovable finds itself at the forefront of a new paradigm in software development. The next 12 months are critical: it needs to prove that its astonishing early growth is sustainable and can translate into a durable business with a diverse customer base (individual makers and enterprises). The company’s strong execution thus far – shipping major product updates monthly, engaging its community, and monetizing effectively – gives confidence. Risks abound (from competition, evolving AI tech, to potential hype burnout), but if Lovable navigates them, it could not only achieve its $1B ARR dream but also fundamentally “catalyze a world of builders”, turning millions of non-coders into software creators. That is a multi-billion (if not trillion) dollar opportunity – one that explains why investors are valuing vibe-coding startups at levels usually reserved for the fastest SaaS in history. All eyes will be on Lovable to see if it can keep up the magic as it transitions from breakout startup to an established platform in 2026 and beyond.

Links

Disclaimer

The content of Catalaize is provided for informational and educational purposes only and should not be considered investment advice. While we occasionally discuss companies operating in the AI sector, nothing in this newsletter constitutes a recommendation to buy, sell, or hold any security. All investment decisions are your sole responsibility—always carry out your own research or consult a licensed professional.