Y Combinator S25: Batch Profile and AI Trends

The S25 batch included approximately 169 startups, according to YC’s directory (other sources cite 167, excluding a few stealth companies). This is on par with recent YC batches and significantly larger than the inaugural Spring 2025 cohort of 144. The batch was divided across a broad range of sectors, though with a strong enterprise slant. Based on YC data and batch lists, an estimated 80–85% of S25 startups are B2B or enterprise-focused, with only a small minority creating consumer-facing products.

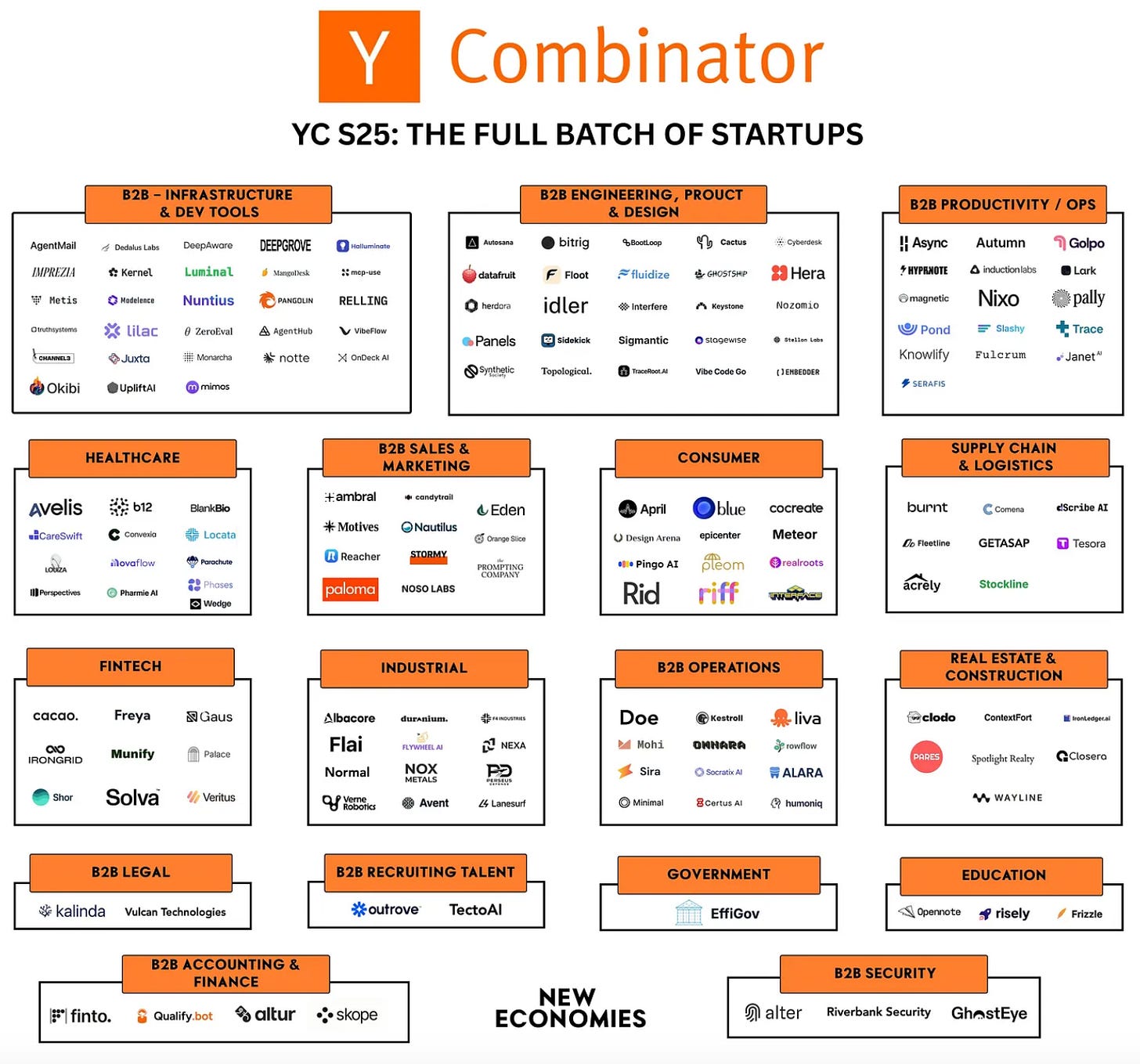

Sector Distribution

Enterprise software dominated. Roughly 30% of S25 companies build developer tools, infrastructure, or other products for engineers, product managers, and designers. Apart from dev tools, other major clusters included B2B productivity & operations (startup workflow automation, HR/legal ops software), healthcare & biotech, industrials & robotics, and fintech. Sectors that were hot in past YC batches – pure fintech, crypto, and Web3 – were relatively quiet this time. For example, only a handful of crypto or blockchain startups were in S25, reflecting the broader cooling in that space. Instead, many fintech ideas were folded into AI “copilots” for finance or accounting.

AI Everywhere

The defining feature of S25 is the prevalence of AI. Over 60% of startups explicitly reference “AI” in their one-liner or pitch. Many others use machine learning under the hood without labeling themselves AI companies. This is a marked increase from batches a year or two ago. Notably, YC’s own Requests for Startups for Summer 2025 put AI at the core of each priority area, which drove an influx of AI-centric applications. Within the AI-heavy cohort, a large subset can be described as “agentic AI” startups – those building autonomous agents or AI copilots that perform tasks for users. In the Spring ’25 batch, ~70 out of 144 companies fell into this category, and S25 continued that trend (likely at or above 50% of the batch). In effect, if Winter 2025 was the rise of the AI agent, Summer 2025 was the entrenchment of AI agents across verticals.

Geography

S25 was one of YC’s most international batches to date. YC hasn’t published official country counts for S25, but the presence of startups from India, Europe, Latin America, Africa, and beyond was notable from the Demo Day roster. Founders described the cohort as global-first. Still, the United States (especially California) accounted for a large share of companies – with the Bay Area serving as host during the batch, many teams relocated or were founded there. Other common hubs included Bangalore, London, Toronto, and Singapore (based on founder chatter and prior batch stats). This global mix brought diversity in ideas – e.g. an AI voice startup targeting Pakistani languages and fintech solutions for emerging markets – underscoring that innovation is not confined to Silicon Valley.

Stage at Entry

YC companies are early-stage by definition, but there was a spread of maturity within S25. A few teams entered with significant traction or prior funding (some had already raised angel or pre-seed rounds). Most, however, were at MVP or pre-revenue stage on entry and used the YC program to build product and sign initial customers. By Demo Day, a surprising number had real usage or revenue – a testament to the accelerator’s intense pace and the accelerating effect of AI tooling. YC’s president Garry Tan noted that revenue across batches has been growing ~10% weekly on average, as founders iterate faster. Indeed, participants reported that in 2025, three months is enough to close enterprise contracts over $100K – something “a big change” from prior years. The average S25 startup at Demo Day could show either a pilot project, a few paying customers, or at least a live product – a higher bar than in past cohorts where many were purely ideas or prototypes.

B2B vs. B2C

The batch skews heavily B2B. An approximate count suggests only around 15–20% of companies had a consumer-facing product or marketplace. These consumer startups were often in niches like social networking (e.g. one aimed at helping women make new friends in cities), personal finance, or education. The relative scarcity of B2C ideas in S25 is noteworthy – a shift from YC batches 5+ years ago that featured more consumer apps. It appears founders in 2025 gravitated toward enterprise problems (perhaps due to clearer monetization) and AI infrastructure, with fewer chasing the next social or gig-economy app. YC itself highlighted that categories like education and government were least common this batch.

In summary, S25’s numbers tell a story of a large, AI-saturated, enterprise-leaning cohort with global roots. Founders are starting companies in cutting-edge technical areas and also tackling hard industry problems, but the unifying theme is leveraging AI and software to automate everything. It’s a far cry from the crypto-heavy classes of 2018 or the consumer mobile apps of early 2010s – YC’s Class of Summer 2025 is very much a product of the AI era.

Trends and Themes in S25

Three major themes emerged in S25, marking evolutions from Winter and Spring 2025:

Specialized AI Agents (Vertical Focus)

If earlier batches were about building general AI agents or platforms, S25 startups largely pursued narrower, high-impact applications of AI agents. Founders doubled down on domain-specific AI copilots – AI assistants tuned for one industry or function. Where Spring ’25 saw multiple “Cursor for X” dev tools (general-purpose AI coding partners), Summer ’25 brought agents that deeply understand one problem: automating insurance claim appeals in healthcare, streamlining mortgage applications in fintech, optimizing warehouse logistics, and more.

This verticalization of AI means startups aim to actually solve a complete workflow in a target domain, rather than just provide a toolkit. It matters because customers in 2025 demand tangible outcomes from AI. YC’s partners had explicitly invited founders to apply agentic AI in creative new ways, and the batch delivered. Many S25 companies pitched “AI that does XYZ task for you,” often replacing busywork that previously required human labor. This trend towards applied AI agents indicates the AI boom is maturing: startups are seeking defensible niches (with proprietary data or expertise) to avoid competing head-on with Big Tech’s general AI offerings. Compared to Winter ’25, which introduced the agent concept broadly, Summer ’25 startups had to answer “Why this AI agent?” and show domain depth.

Surge in Developer Tools & AI Infrastructure

Another clear theme was a wave of startups building for developers, data scientists, and IT – effectively the picks and shovels of the AI gold rush. Over 30% of S25 startups fell into dev tools, cloud infrastructure, or AI tooling categories. This includes everything from AI-assisted coding tools and testing frameworks, to data platforms for model training, to new chip architectures for AI workloads. The timing is no accident: with so many companies adopting AI, there’s intense demand for tools to simplify and accelerate software development. YC noticed this and many accepted companies are those easing pain points in the AI dev pipeline. For instance, some startups tackled AI quality evaluation (how to benchmark and improve AI model outputs) – one team built an LLM evaluation platform already used by an AI search company.

Others, like a “Figma for AI agents” collaborative builder, reflect efforts to make agent creation accessible to non-engineers. A related sub-trend is automation in software implementation and integration: one standout automates enterprise software deployments, promising to save weeks of manual work in SAP/ServiceNow rollouts. The prevalence of dev-tool startups in S25 (significantly higher than Spring ’25) suggests that infrastructure is back in vogue. After a period where end-user applications got all the attention, the pendulum swung towards enabling technologies – likely because founders saw that everyone building AI needs better tools. It also indicates a more cautious environment: building picks-and-shovels can be seen as lower risk than betting on a single consumer app, and investors were receptive to these behind-the-scenes plays.

Reawakening of Hard Tech and Industry Ops

Amid the AI frenzy, S25 also featured a modest revival of hard tech and real-world industry startups. This is a notable shift from Spring ’25, which was almost entirely software. In Summer, a number of companies ventured into atoms as well as bits: robotics, advanced hardware, climate tech, and biotech. For example, one startup is building 3D-integrated chips to overcome the limits of 2D semiconductors – an ambitious approach that prompted some investors to call it a potential “next Nvidia.” Another worked on AI-driven drones for industrial inspections, continuing the interest in drone tech noted in late 2024. In biotech, there were startups like a new immunotherapy developer touting dramatically improved cancer treatment results in animal studies. And in the climate tech realm, at least a couple of companies aimed at sustainability – one example is an AI model for ultra-accurate weather prediction (vital for climate and agriculture), inspired by founders’ prior work at Microsoft Research’s weather project.

Why does this hard tech mini-resurgence matter? It shows that YC’s reach is broadening again: beyond pure internet software into tough, foundational problems. Many of these areas (chips, biotech) require longer R&D and more capital, yet YC is funding them, and they resonated with certain investors looking for the next deeptech breakthrough. It’s a contrast to Winter ’25, when nearly all headlines were about AI agents and few about hardware or science. Now in S25, with AI as a baseline, some teams are leveraging it within hard tech (e.g. AI to design chips, AI in robotics) to push the frontier. This blend of AI + hard tech could yield startups that define new markets (and it helps YC diversify its bets). The theme also underscores an understanding that not every problem is solved with just a prompt – sometimes you need to invent new devices or molecules. In the long run, S25 might be remembered for seeding a few deeptech companies alongside the AI apps.

Beyond these three, other themes included the automation of business workflows (many B2B SaaS aimed to fully automate tasks in ops, compliance, customer service, etc., eliminating the need for human back-office roles) and the ongoing trend of “AI for X” in traditional sectors (from construction to insurance). Notably absent as a theme were things like crypto/web3 or direct-to-consumer commerce – a telling sign of where founder energy has shifted. Overall, the S25 batch’s themes reflect an inflection point: AI’s integration into everything, paired with a rekindling of interest in complex, real-world innovation where AI alone isn’t enough.

Geography and Go-to-Market

U.S. vs. International: The S25 batch continued YC’s trend of internationalization. While the U.S. (especially California and New York) produced the largest share of startups, a considerable portion – roughly 40% by some estimates – had primary founders from outside the U.S. This includes companies headquartered abroad and those started by international founders who moved to SF for the program. Notably, India was a significant source of startups, particularly in AI and fintech (YC has seen rising Indian founder presence in recent years). We also saw startups with roots in Canada, the U.K., France, Brazil, Nigeria, Pakistan, and more. YC’s own outreach globally (via Startup School and events) in 2024/25 has paid off with this diverse pipeline. The advantage for S25 founders is clear: they can tackle problems in huge markets outside the saturated U.S. For example, fintech startups addressing emerging markets or voice AI focusing on non-English languages bring a fresh angle that stood out. For investors, non-US companies can pose additional diligence (legal structures, market unfamiliarity) but YC’s imprimatur and network help mitigate that. One observed geo-trend: Latin America’s representation dipped compared to some previous batches, possibly due to macroeconomic issues, whereas Europe and Asia held strong. In terms of top cities, San Francisco remained king – many international teams relocate for YC and often stay, so SF had dozens of S25 companies present. Outside SF, other notable hubs included Bengaluru, London, Toronto, Lagos, and Singapore, reflecting where tech ecosystems are robust.

Sales Motion (B2B)

Given the batch’s B2B dominance, go-to-market strategies were critical differentiators. Many S25 enterprise startups opted for a “land-and-expand” sales strategy: start with a small pilot or a team-level sale, then expand usage within the client after proving value. This was evident with AI SaaS companies that offered a free trial or a limited-scope pilot (often 1 use-case or 1 department) to lower the barrier for corporate customers. For instance, an AI customer service startup might deploy a chatbot for one support team at a bank as a pilot; upon success, they aim to roll it out bank-wide. YC companies often leverage the network for introductions – S25 founders tapped YC alumni at big firms or the invested advisor network to get those crucial first pilots. We saw that startups with pre-Demo Day pilots or LOIs from reputable companies had a clear edge. Some enterprise startups even had paying customers by Demo Day, which was a strong signal in investor conversations – indicating a shorter sales cycle or extreme customer pain point.

Product-led Growth (PLG)

On the flip side, developer tools and SaaS targeting SMEs went for product-led growth. These companies often offered a free tier or open-source version to drive adoption. The idea is to get individual developers or small teams using the product, then convert a fraction to paid or upsell premium features. S25 had numerous dev tool startups and nearly all embraced online distribution – think self-serve signups, documentation, and maybe a community Slack or Discord for users. A concrete example: a testing tool might be free for individual devs, but require a paid plan for team collaboration features. This PLG motion can lead to impressive user numbers even pre-revenue. Investors in S25 likely asked these startups about activation rates, developer community size, and bottom-up adoption evidence. The ones that could say “500 developers at 100 companies use our tool weekly” at Demo Day – even if only a few pay now – established a growth narrative that traditional enterprise sales startups cannot match at that stage.

Enterprise Sales & Pricing

For startups with high ACV (annual contract value) products – say those selling to large enterprises or offering mission-critical solutions – sales cycles are longer, but a surprising number managed to shorten these cycles by leveraging YC’s credibility. It was reported that some S25 companies closed enterprise deals in mere weeks, something previously rare. Part of this is the aforementioned pressure and hustle within YC. Another factor is simply 2025 market conditions: enterprises are keen not to miss out on AI advantages, so they’re willing to fast-track trials with startups that can deliver AI capabilities. Pricing models varied: many did subscription (SaaS licensing) often usage-based (e.g., per number of AI agent runs, or per user/month). A few infrastructure startups went with “pay-as-you-go” cloud-style pricing, aligning cost to consumption (attractive to developers). Hardware-oriented companies plan to do pilot projects or proofs-of-concept first, sometimes free or subsidized, then later sell hardware or Robotics-as-a-Service contracts. YC advises startups to charge early, and indeed several S25 teams proudly announced they were already generating revenue – even if just pilot fees. This batch seemed to shy away from the old “grow at all costs, monetize later” playbook; given tighter funding, demonstrating a viable revenue model (however small initially) was a priority.

Top Go-to-Market Takeaways

YC S25 founders largely adopted go-to-market strategies that matched their audience:

Developer-focused companies embraced viral product-led tactics, open sourcing parts of their tech or writing technical content to draw interest.

Enterprise AI companies often used a consultative sales approach initially – a few founders mentioned acting almost like solution consultants to land the first customer, then using that success story to build a repeatable sales process.

Startups in regulated sectors (health, fintech) smartly sought partnerships (with clinics, banks, etc.) early, trading some customization or compliance effort for a foot in the door. For example, a health AI startup partnering with a hospital gave them data access and a validation point for FDA eventual processes.

Consumer startups in S25 often relied on community building and word-of-mouth due to limited marketing budgets. RealRoots, for instance, leveraged social media groups and referrals among participants rather than big ad spends – focusing on delivering a great experience that would generate buzz among friends.

One interesting observation: With YC now running quarterly batches, some investors felt startups were coming into Demo Day slightly less polished on go-to-market than in the past, perhaps due to the shorter runway. But S25’s best managed to articulate credible strategies anyway. And post-Demo Day, many joined programs like YC’s Sales Bootcamp or leaned on serial entrepreneurs in the network to refine their sales playbooks for scaling.

Risks and Caveats

While the S25 batch is brimming with innovation and ambition, it also highlights several risks and caveats that founders and investors should keep in mind:

Market Saturation and Similarity

The elephant in the room is the sheer number of AI startups doing overlapping things. When more than half of the batch is AI-focused, inevitably many are pursuing similar ideas. We saw multiple “AI agent for code,” several “AI copilots for bookkeeping,” and others in related categories. This raises the risk of market saturation. Not all can survive; many will compete directly or indirectly, and some will flame out as features rather than stand-alone products. An insider quip from a founder was “you hear the phrase ‘AI agent’ so much you go insane.” YC itself acknowledged that many startups exploring similar areas can be a good thing for open-source progress, but it absolutely means intense competition. Investors worry that in a year, there will be consolidation: perhaps only a few AI agent platforms will dominate, acquiring or pushing out others. For founders, this saturation means it’s harder to differentiate. Having “AI” in your pitch is no longer novel; real traction or proprietary tech is needed to stand out. It’s a risk that some S25 teams might be too alike and end up in a race to the bottom on pricing or a fight over the same customer pools. The caveat for investors is to pick the category winners and avoid funding duplicative companies, lest they end up betting on a future acqui-hire.

Regulatory and Compliance Challenges

Many S25 startups operate in heavily regulated sectors – finance, healthcare, insurance, transportation, and others. While they often pitch “we use AI to navigate regulation,” the reality is regulators themselves could pose a roadblock. For example, an AI that automates mortgage processing must comply with lending laws and fair credit rules. Any bias or error could invite lawsuits or regulator ire. Similarly, healthcare AI that acts without human oversight might face classification issues. We also have looming horizontal regulations on AI: the EU’s AI Act, expected to be enacted around 2025, could impose strict requirements on “high-risk AI systems,” potentially including some products S25 companies are building. Privacy laws such as GDPR and California’s CPRA could limit how startups train models on user data.

In short, regulatory risk is high. Startups that ignore this may hit a wall when trying to sell to enterprise customers who demand compliance. Another facet is labor regulations: companies offering automated services in regulated professions (legal, accounting) might face pushback or the need for licensed experts in the loop. Founders must be careful not to “move fast and break things” in domains where breaking things can mean legal injunctions or harm to life or property. The caveat for investors is to ensure their startups have solid answers on compliance. Some S25 companies are wisely automating compliance itself, which is meta but useful.

Technical Feasibility and Hype vs Reality

There’s no doubt that some S25 startups are very early on the tech development curve. Especially in deeptech – like quantum-accelerated AI, new silicon, or biotech cures – technical risk is prominent. Will the quantum approach actually work at scale? Can the new chip be fabricated and achieve the promised 28× efficiency gain outside a lab prototype? These are open questions. We saw in previous eras, such as blockchain startups from 2018, that not all ambitious tech claims pan out. AI startups also face the risk that current AI models have limitations (hallucinations, reliability issues) that might make certain applications unviable without breakthroughs.

For instance, an AI legal advisor might work 90% of the time and fail 10% in ways that no law firm would accept. There’s also a risk of relying on third-party AI models. If a startup is essentially a thin layer over someone else’s API, what stops the API provider from adding the same feature or a competitor from doing the same? Technical moats are thin for some. Many S25 companies tout using proprietary data or fine-tuning as a moat, but it remains to be seen if those are enough. Overhype is a related risk. Investors and media hyped “next Nvidia” or “GPT for X” narratives, but if milestones aren’t met, there could be a quick backlash and valuation down-rounds. Founders must be careful not to over-promise on tech. Those that do could face trust erosion. We already hear whispers that some demo day videos glossed over current product shortcomings. As reality sets in during execution, a few startups might find their tech is years away from working reliably – and that gap is perilous.

Funding Environment Caution

While we noted strong seed activity, the broader funding climate beyond seed is still cautious. Series A investors in 2025 are famously raising the bar. The risk of a funding crunch in 12–18 months is real, especially if macroeconomic conditions wobble or if the AI hype cools. Many S25 companies will need another round before profitability. If they can’t show significant progress in revenue, user growth, or technical milestones, they might struggle to raise A rounds. The caveat emptor for founders: raise enough now and control burn. We’ve seen prior batches where companies that hired too fast or spent big on growth without product-market fit hit a wall. Already some investors are advising AI startups to moderate cloud spending, since training models is expensive, and prove efficiency. In essence, there’s risk in assuming capital will always be plentiful. The venture market is fickle. A few high-profile misses in the AI sector or regulatory clampdowns could cause funding to tighten again.

Talent and Execution Risks

YC S25 founders are younger on average (median age 24) and notably many are first-timers. With youth comes energy and new ideas, but also execution risk. Running a company, especially scaling one, is hard to learn on the fly. Some founders might falter in the face of hiring challenges, scaling product, or simply managing the stress. The so-called “YC slump” after the high of Demo Day has been mentioned by past participants. The risk of burnout is non-trivial. The accelerated pace pushes founders to achieve a lot in 3 months, sometimes at the cost of technical debt or unsustainable workloads. After Demo Day, reality hits: it could take years to build a viable business. There’s also the risk of attrition. In every batch a few companies pivot radically or quietly disband if things don’t click. S25 likely won’t be different. The plethora of similar companies might cause some to merge or some founders to jump ship to better-performing peers. We might imagine acqui-hire scenarios or talent poaching among AI startups. Investors thus must be vigilant post-investment – providing support to keep these teams on track and not flame out.

Conclusion

YC S25 offers a snapshot of where early-stage startups are headed – and the playbook is clear:

embrace AI, but bring substance.

Simply having an AI angle is no longer enough; the standout founders in S25 identified specific, pressing problems and applied AI or automation in a way that gives a 10× improvement (be it speed, cost, or quality).

Links

Disclaimer

The content of Catalaize is provided for informational and educational purposes only and should not be considered investment advice. While we occasionally discuss companies operating in the AI sector, nothing in this newsletter constitutes a recommendation to buy, sell, or hold any security. All investment decisions are your sole responsibility—always carry out your own research or consult a licensed professional.